Feed wheat prices have remained at a noticeable premium above feed barley during August, according to the latest report form AHDB analyst Charlie Reeve.

Mr Reeve explained: “A challenging growing season is likely to see the UK wheat crop around the 10Mt mark this year – volumes not recorded since the early 1980’s. However, given the global surplus of wheat, UK prices will likely be capped at import parity, with supply fundamentals from large global exporters having a strong sway on the UK price.

“What could be affected in the coming months will be delivered premiums, with buyers having to incentivise wheat to move North and West to homes across the UK”.

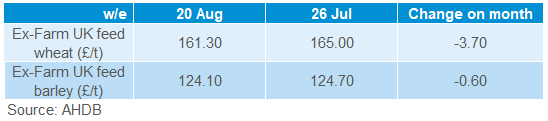

Feed wheat prices are now beginning to recover after falling from £164.30/t at the start of the month. Ex-farm feed wheat prices reached £161.30/t on 20 August while feed barley prices sat at £124.10/t, thus creating a difference of £37.20/t on the day.

UK wheat futures have also been strengthening over the last fortnight, with the November-20 contract closing at £166.90 on 26 August.

Early yield estimates from AHDB’s third harvest report peg domestic wheat yields between 7.3 – 7.7 t/ha, based on 59% harvest completion. This is back on the 5-year average of 8.4t/ha

And barley prices are looking relatively bearish in the short term, the large expected production and sizeable carry from 19/20 two of the pressurising factors.

Proteins

“This years rapeseed crop looks to be one of the lowest on record, with current industry predictions pegging it around the 1Mt mark,” Reeve commented, adding that AHDB’s harvest reports have been highlighting the wide variability recorded in this year’s yields, with current estimates at 2.6 – 3.0t/ha.

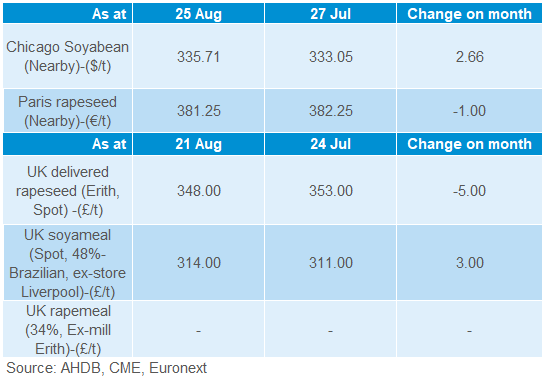

Additionally, US-China trade of soybeans has been impacting on global oilseeds markets. China has been purchasing a large volume of soybeans from the US for several weeks now, which has been helping to support global prices. Storm damage in the US across the Mid-West, and the most recent USDA crop condition report being not so optimistic about US soybean conditions has given them some price support recently.

This has lent some support to rapeseed prices. After peaking in mid-July, delivered rapeseed (Nov-20) for Erith had been softening into August. This movement was reversed last week (21 August), with prices quoted at £348 last Friday.